Every first time real estate buyer has a lot of questions. And here at Property Pilipinas, we try to answer them one by one.

Part 1 discussed the definitions of the items in the Sample Computation. In Part 2, we learned how to compute for the net downpayment that has less the discount and the reservation fee. Here in Part 3, we will now take a closer look at the remaining balance and how we can pay it.

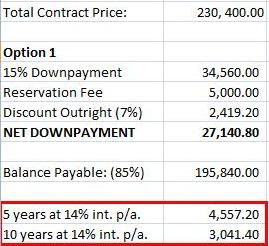

Let's take another look at our Sample Computation from Part 2:

Now that we have completed the computation for the downpayment, let's see how much remaining balance we should be paying in the next 5 to 10 years. To get the Balance Payable, we use the formula below:

BALANCE PAYABLE = Total Contract Price - Downpayment

therefore:

BP = 230,400.00 - 34,560.00

BP = 195,840.00

In the computation above, you'll notice that instead of using the Net Downpayment we computed in Part 2 (21,140.80), we used the original 15% downpayment. This is because the Net Downpayment does not affect the downpayment indicated in the contract. The deductions given to the buyer for the reservation and the discount serves as a bonus for the buyer paying early on. If it were a different case, the buyer who would not be able to avail the discount would still be entitled for a deduction for their reservation fee. Still, my disclaimer applies. Not all companies follow this kind of policies so it would still be best to check it with your agent.

With the Balance payment computed, you are now given two choices on how long you plan to pay the remaining balance. Here you will see why it is better to pay early and/or in full rather than take the much longer time period.

Here you are given two choices. First is to pay the remaining balance in 5 years, but with 14% interest per annum. Or you can pay the balance in 10 years. So what's the difference between the two? We'll have to take our final Math trip to find out.

Below is the formula for computing the monthly amortization:

MONTHLY AMORTIZATION = Balance Payable x Factor Rate

Okay. So what the hell is the Factor Rate doing in that equation? Where did that one come from?

You've probably seen banks giving away a booklet filled with several numbers. This booklet is what they call the Monthly Interest Amortization Table. The numbers inside are called Factor rates, and these rates save us the time and effort of computing since all you have to do now is multiply the Factor rate to the balance. The formula for getting the factor rate is as follows:

i/12

MC = ______________

-n(12)

1 - ( 1 + i /12)

where:

MC = factor rate

i = interest rate

n = no. of years

Of course, since its much easier to just look at the whole table, we'll just use the factor rate instead. Again, the Mortage Amortization formula is

MONTHLY AMORTIZATION = Balance Payable x Factor Rate

therefore:

MA = 195,840.00 x 0.02327

MA = 4,557.20

So for 5 years, you'll be paying 4,557.20. Using the same formula, if you chose to pay in 10 years instead, you'll be paying 3,041.40. Much lower than the previous one, right? Then that means you are paying less, right? Wrong!

Let's make a comparison between the three values.

Balance Payable: 195,840.00

5 years: 4,557.20

10 years: 3,041.40

Now let's see how much you end up paying after the said number of years.

Balance Payable: 195,840.00

5 years: 4,557.20 x 12 months x 5 years = 273,432.00

10 years: 3,041.40 x 12 months x 10 years = 364,968.00

So as you can see, the longer it takes for you to pay the full amount, the bigger the amount will be eventually because of the interest rate. The best solution would always be to pay as soon as possible. That way, you don't have to pay a bigger amount, you also get to enjoy your property at a much earlier time.

For any comments, suggestions, or inquiry, please go to the "Contact Us" page.